Catholic Candle note: Below is an article concerning the U.S. economy in particular, and, by analogy, pertaining to the economies of other Western countries.

Catholic Candle usually writes on topics more directly related to the Catholic Faith, as well as Catholic philosophy and Catholic practice. But there is an ongoing cultural and political revolution all around us, and this revolution has other aspects too. That is why we also write on topics that could be called “political”, in order to shine a light on current evils in government and society. Here are examples of such Catholic Candle articles:

➢ The COVID-19 “Vaccine’s” Harms Continue to Be Further Revealed: https://catholiccandle.org/2024/02/20/in-case-you-missed-it-february-2024/

➢ Glacier-Melting Alarmism: https://catholiccandle.org/2024/01/23/glacier-melting-alarmism/

➢ The Leftist Attack on the Moral Fiber of Society: https://catholiccandle.org/2023/10/29/the-leftist-attack-on-the-moral-fiber-of-society/

➢ The “Deadly Heat” Alarmism: https://catholiccandle.org/2023/08/24/the-deadly-heat-alarmism/

➢ The False Principle of “Diversity and Inclusion”: https://catholiccandle.org/2022/01/05/the-false-principle-of-diversity-and-inclusion/

➢ “Big Data” – a New Version of an Old Danger of Manipulation and Deception: https://catholiccandle.org/2021/12/11/h/

➢ Black Lives Matter is Showing its “True Colors” – and They are Red: https://catholiccandle.org/2021/10/03/black-lives-matter-is-showing-its-true-colors/

➢ The Evil & Dangers of Yoga: https://catholiccandle.org/2021/09/05/the-evil-dangers-of-yoga/

➢ Wikipedia – a Deceptive Tool of the Leftists: https://catholiccandle.org/2021/08/02/wikipedia-a-deceptive-tool-of-the-leftists/

➢ The Current Leftists Follow the Usual “Tyrant’s Playbook”: https://catholiccandle.org/2021/05/03/the-current-leftists-follow-the-usual-tyrants-playbook/

➢ Empathy – a Tool for Good or for Evil: https://catholiccandle.org/2021/04/02/empathy-a-tool-for-good-or-for-evil/

➢ Reject the COVID Vaccines! https://catholiccandle.org/2021/01/01/reject-the-covid-vaccines/

➢ Face masks present grave health risks & are to control people, not a virus: https://catholiccandle.org/2020/12/01/856/

Catholic Candle holds that the globalists are positioning the U.S. economy and other economies in the Western World to be pushed into collapse if and as needed, to compel people to accept a future globalist tyranny.

Thus, we have an eye on the economy in order to monitor (in a general way) its condition and its readiness for use as a weapon compelling acceptance of a globalist tyranny.

The Condition of the U.S. Economy and Comparing it to Leftist Spin about the Economy

The National Debt

We live in dramatic times! For “starters”, let us note that the National Debt Clock (using government data) currently shows the federal debt to be about $34½ trillion! Here is a screen shot of the “U.S. Debt Clock” from a few days ago:

That is such a huge number it is hard to grasp in “everyday” terms. One of the Catholic Candle Team checked this same “debt clock” almost 15 years ago, on March 6, 2009. On that day, the “debt clock” was $10.95 trillion. So, for comparison purposes, in nearly 15 years, the U.S. National Debt has increased more than $23 trillion!

The St. Louis Federal Reserve Bank has graphs showing the growth of the U.S. National Debt. Here is the graph which we downloaded a few days ago:

This graph available here: https://fred.stlouisfed.org/series/GFDEBTN

This graph shows the same thing as the debt clock, viz., on roughly March 6, 2009 the graph shows (roughly) the National Debt of $11 trillion.

Look how the National Debt has skyrocketed in the last 15 years especially! The above graph starts at roughly 1965. From that date, it took (roughly) 20 years to reach the first $1 trillion, and (roughly) ten more years to add another $5 trillion to that amount (with a total debt of $6 trillion at about 1995). Then it took about 13 years to add another $5 trillion to that (to a total of about $11 trillion in 2009). In the 15 years since 2009, the National Debt has increased more than $23 trillion!

Such increases in our country’s debts are unsustainable. Drunken sailors spend their money more carefully than our government! Where is this all leading? Ask yourself that.

The Annual Federal Deficit

Here is a little more information to help us to extrapolate where this is heading.

Every year, the U.S. government makes fiscal matters much worse by adding to the National Debt. And the government is adding to the total debt at a faster rate. The U.S.’s annual budget deficit (i.e., the amount by which federal spending exceeds federal revenue) is currently 16% higher than it was a year ago.[1]

The federal deficit for the first third of the current fiscal year is $532 billion.[2] Multiplying this number by three (in order to “annualize” this deficit) shows that we are running an annual deficit of about $1.6 trillion ($532B x 3 = $1.596 trillion). This shows the U.S. is running a larger budget deficit compared to the average of the last 15 years.

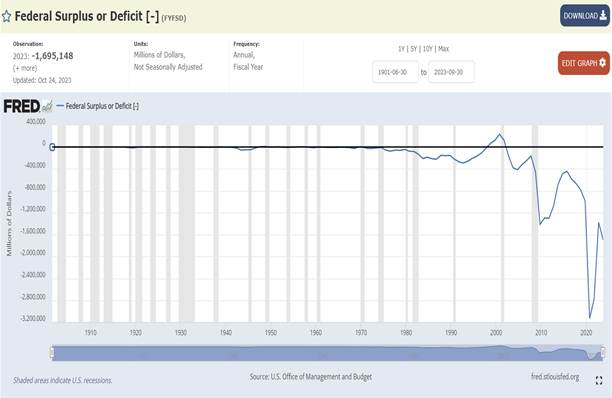

The St. Louis Federal Reserve Bank calculates the current annual federal budget deficit as larger than that – viz., approximately $1.7 trillion (viz., $1.695T). See the upper left-hand corner of the graph below.

This graph is found here: https://fred.stlouisfed.org/series/FYFSD

Notice on the St Louis Fed’s graph that, although the average of the last 15 years is $1.5T, the larger deficits are more recent. Although the largest federal budget deficits were during the COVID scare, nonetheless, after this so-called “pandemic”, the deficit spending level continues to be larger than the largest deficits before that. Again, the federal government’s current annual budget deficit is roughly $1.6T or $1.7T So the U.S. government is adding a huge amount to the enormous existing federal debt. So, extrapolating to this time next year (2025) the National Debt will be $36.2 trillion (or more). And so on.

U.S. Gross Domestic Product (GDP)

Is there any good news about the economy as a whole? Perhaps you have heard that the most recent numbers for GDP (Gross Domestic Product) were higher than expected. The mainstream media treated this as a good thing. For example, one leftist news source, CNN, called the current GDP number “shockingly robust”.[3] Strong GDP growth would have been good under other circumstances but not under the present ones. Let us explain.

The GDP is an important measure of national economic activity. It is supposed to measure increase or decrease of the nation’s wealth by measuring economic activity. But the GDP does this imperfectly and is, literally, simply measuring spending. When this spending reflects increases (or decreases) of economic activity related to homes constructed and factories built, cars made, crops grown, etc., then GDP is a reasonably good proxy to measure the increase (or decrease) in the nation’s wealth.

But at present, this higher GDP largely reflects more government spending. The government makes almost nothing and so its expenditures, for the most part, do not reflect things built and produced. Government expenditures commonly reflect lots of waste. For example, the government wasted hundreds of billions of dollars doling out COVID relief money which was stolen by fraudsters.[4] Even the non-fraudulent trillions of COVID freebies the government handed out were not productive but largely paying for people to stay home.

Yet, even when the government spending is wasted or spent unproductively, it is counted as part of the GDP as long as the government money is spent/paid.[5] So if the government spent money hiring persons to dig holes and then fill them in again (an unproductive activity), this would be counted as an increase in GDP, since money was spent on this.

With lots of wasteful government spending, it not only increases the federal debt and deficit but it is also counted as an increase of GDP and so is counted as a sign of a supposed “healthy economy”.

Besides out-and-out government waste, the government also spends huge amounts of money on non-productive activities, e.g., hiring more bureaucrats, passing more laws, enacting more regulations, increasing social welfare spending, etc.

Further, our corrupt government’s spending so often does great harm. Our Corrupt Government is about the only thing concerning which it would be better if we do not receive our “money’s worth”. So often, we would be better off if our corrupt government just burned money instead of spending it.

So, unlike when the private sector manufactures, mines, or otherwise produces goods, the increase in GDP because of a strong increase of government spending is a bad thing, not a good thing, especially when it is deficit spending (as it is).

Thus, we have the government wasting money and causing much harm by spending money that it does not even have, and which it borrows.

Common sense shows the evil of this situation.

This federal spending is not like a family increasing its spending (investing) in order to buy a house, a farm, or a car. The increases in spending of the federal government are for its “living expenses”, e.g., current welfare payments, current healthcare welfare payments (Obamacare etc.), current freebies for everything from unnecessary grants to foreign aid.

This is like a family continually spending beyond its means for current expenditures in its monthly bills, e.g., food and rent. The government’s spending is like a business which is borrowing to meet its current payroll and to pay rent for its factory building. Such a business, or family, or the government is living beyond its means and is heading toward ruin. We see that the government is spending like that now.

Is There a “Biden Bull Market”?

Let us briefly examine what the mainstream media says is the current “bull market” during the Biden presidency. A “bull market” is a stock market that is rising because of a healthy and strong economy.

The mainstream media call the current stock market a “bull” market attempting to paint the economy as strong. But “regular people” experience something largely the opposite. That is why, for example, a few days ago The New York Times, in its election coverage, proclaimed that, despite the robust economy the voters are not giving Biden the credit for this.

In other words, according to the media, Biden’s economy is really good but the voters somehow don’t realize this “fact” and so aren’t grateful to him. The mainstream media misuses the economic data to claim there is a “Biden bull market”.

Regardless of what the media claims, inflation is causing prices to go ever higher and people know this fact when they go to the grocery store, the gas station, etc. Consumer prices have risen 20% in the last four years, according to government-issued statistics.[6] There is good reason to believe that the government inflation numbers are a lie and a deceptive minimizing. The apparently-more-accurate estimates show that last year’s inflation rate was about 18% and that the rate was 24% over the last four years.[7]

In that same four-year period, the costs which producers pay is up 35%.[8] This gap between consumer and producer inflation is a typical pattern because, when producers’ costs go up, the producers initially absorb some of the increase in order to avoid angering consumers and losing market share. So, although the producer inflation rate is now higher than the consumer rate, producers can only absorb the cost differential for so long. Inevitably, consumer inflation will “catch up” to producer inflation eventually.

In this same last four years, the nation’s money supply has increased a whopping 39%![9] This extraordinary increase shows us where our economy is heading. This large increase in the money supply must result in greater inflation in the future. When everyone has more money without changing the amount of goods available for purchase, then this circumstance MUST cause inflation. For example, if suddenly, everyone received $1,000,000 with no increase in goods available, then people would be willing to pay a lot more for any given item. Prices would go up. This is inflation. One way the economists speak of this situation is that “there are more dollars chasing the same quantity of goods”.

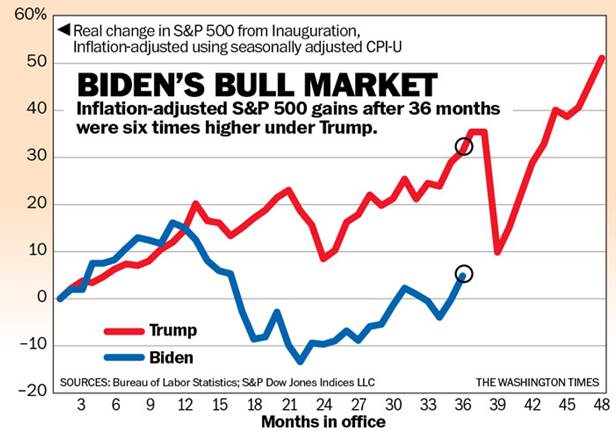

With all of this inflation, let us ask ourselves how this impacts Biden’s supposed “bull” market, i.e., the recent increase in the stock market. Of course, with each dollar being inflated and worth less, the price of stocks must increase just to stay even in terms of “real dollars”. This is like the fact that if there is a doubling of the money supply with no additional goods produced, then we would expect that the stock market would compensate and, over time, roughly double the price of the stock shares for sale, just to keep the shares valued at the same price in terms of “real dollars”.

Further, the current supposed “bull” market is a reversal of the previous Biden “bear” market and makes up for the stock market “tanking” and being about 15% lower in about October 2022 compared to when Biden took office. In other words, most of the increase during the Biden “bull” market is merely making up for the 15% decline earlier in Biden’s tenure.[10] So after taking account of the current stock market rise which merely returns the market to the pre-Biden level, and then after adjusting the market for inflation, the stock market’s increase is anemic and is a smaller annual increase than the average annual increase over the last 30 years.

In contrast to Biden’s supposed current “bull” market, during Trump’s presidency, the S & P 500 stock index increased 36% in real, inflation-adjusted terms. Below is a graph comparing how the stock market performed during the Trump and Biden presidencies, after adjusting for inflation:

This graph is available here: https://www.washingtontimes.com/news/2024/feb/21/what-bull-market-two-thirds-of-stock-market-rise-u/

So, we see that, as the economists say, “there is no such thing as a free lunch”. When the federal government prints trillions of dollars “out of thin air”, this results in “more dollars chasing the same number of goods”. This resulted in inflation and these inflated dollars caused, in part, the Biden fake “bull” market.

Conclusion

The U.S. economy is on a path to ruin.

The leftist agenda is bad for the economic health of the country and this Biden “bull” market is just another leftist lie.

We live in a strange and daunting time, so we must place ourselves in God’s Hands, by acts of our wills and intellects.

Also, we must pray for our country, help each other, and pray for each other!

If we use this present time the way God wants us to use it, then this is a time of great blessings and merit!

[1] https://www.theepochtimes.com/us/us-budget-deficit-widens-16-percent-as-interest-costs-surge-treasury-5585773

[2] https://www.theepochtimes.com/us/us-budget-deficit-widens-16-percent-as-interest-costs-surge-treasury-5585773

[4] https://www.nbcnews.com/politics/justice-department/biggest-fraud-generation-looting-covid-relief-program-known-ppp-n1279664

[6] https://www.theepochtimes.com/opinion/bidens-speech-on-shrinkflation-was-unbearably-bad-5585506?src_src=ref_share&src_cmp=mb-cc

[7] https://www.theepochtimes.com/opinion/the-inflation-rate-hit-18-percent-last-year-worse-than-carter-era-561113

[8] https://www.theepochtimes.com/opinion/bidens-speech-on-shrinkflation-was-unbearably-bad-5585506?src_src=ref_share&src_cmp=mb-cc